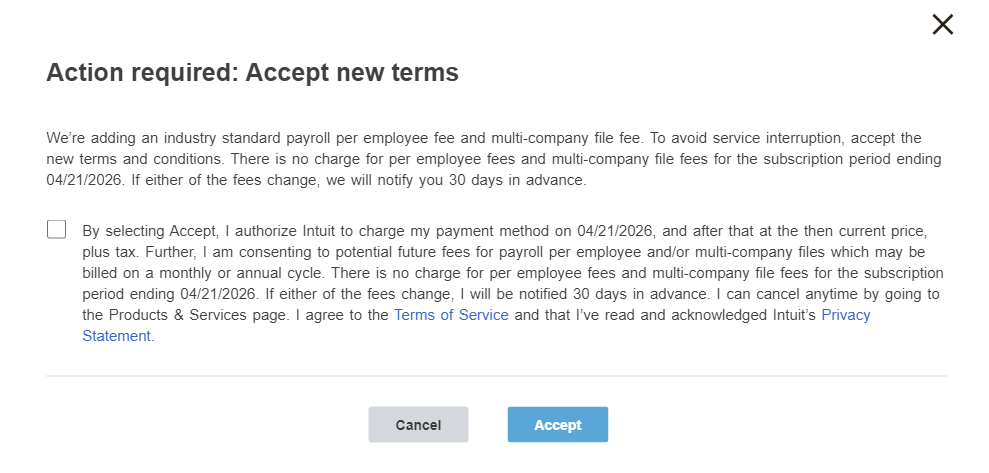

If you’re using QuickBooks Enterprise, it’s important to be aware of upcoming fee changes that could impact your software costs. According to recent messaging inside QuickBooks Enterprise, Intuit plans to introduce two new fees starting in April 2026.

📌 What’s Changing?

- Multi-Company File Fee

Historically, Enterprise users could manage multiple company files under a single license. Starting in April 2026, you may see an added fee for each company file you manage in QuickBooks Enterprise. - Payroll Per Employee Fee (Gold/Platinum Edition)

If you subscribe to QuickBooks Enterprise Gold, payroll has been bundled at a flat rate—regardless of your number of employees.

Beginning in April 2026, Intuit may introduce per-employee payroll fees, similar to other payroll providers.

💡 What Does This Mean for Your Business?

These changes could increase your software costs, particularly if you:

- Manage multiple company files.

- Have a larger payroll base.

The good news is that Intuit is providing advance notice, with these fees not applying until April 21, 2026. This gives you time to:

- Review your software usage.

- Evaluate if Enterprise is still the best fit.

- Explore alternatives if necessary.

- Plan your budget well in advance.

🕒 Next Steps You Should Consider:

- Review your company files:

How many separate files are you managing today? - Review your payroll usage:

Will a per-employee fee impact your costs significantly? - Consider your options:

If these changes don’t align with your needs, you still have time to plan.

Need help reviewing your QuickBooks setup before these changes? Please contact us to start a conversation.

Image in Product, May 2025: